But effective systems can save you valuable time and ensure the financial health of your daycare center. Professional daycare accounting software can help you send invoices, track revenue, manage expenses and more. It can even send reminders to parents for late payment and accept credit card payments with ease. Vendor Management and Payment Tracking-Daycare facilities rely on a diverse range of vendors, from educational material suppliers to catering services and maintenance contractors. Implementing a robust vendor management system is essential for tracking invoices, monitoring payment due dates, and ensuring timely settlements. By maintaining comprehensive vendor records and streamlining payment processes, daycare owners can cultivate strong business relationships, avoid late fees, and maintain a positive credit standing.

Integration with Bookkeeping Software

For instance, the Child and Adult Care Food Program (CACFP) provide reimbursement to qualified childcare providers for a portion of childcare food costs. Childcare subsidies are also available from the federally funded Child Care and Development Fund (CCDF), find your local program here. If you plan to open your daycare business in a residential area, check your deeds and HOA agreement to see if there are any restrictions.

Frequently asked questions to starting a daycare

Navigating the intricacies of payroll processing for such a diverse staff can be a time-consuming process. It’s impossible to run a successful daycare business without managing your finances. While some incorrectly consider bookkeeping and accounting to be the same, it’s necessary to differentiate between the two as you plan to incorporate bookkeeping into your operations. Turn numbers into information that can help your daycare business grow.

Success

These are just a few of the many advantages of starting your own daycare center. Now let’s address some common questions you may have about being a daycare business owner. Follow along with this guide as we reveal the step-by-step process for opening a successful child care business.

- Choose an accounting system or software that suits the needs of your daycare business.

- Be sure to review these to make sure you have enough staff for the number of children you plan on caring for.

- First, start by separating your personal and business financials, then establish a consistent accounting process.

- You can ensure your daycare survives and thrives by creating a solid financial foundation, setting competitive tuition rates, reducing costs, and maintaining meticulous financial records.

- This proactive approach ensures that budgets remain relevant and aligned with the facility’s evolving needs.

Implementing robust revenue recognition policies and procedures, aligned with industry best practices and accounting standards, can ensure accurate financial statements and informed decision-making. Maintaining a positive cash flow is vital for the smooth operation of your daycare. Keep track of the timing of income and expenses to ensure sufficient funds are available to cover ongoing costs. Regularly review your cash flow statement to identify potential cash flow gaps and make informed financial decisions. If you need more certainty about any financial aspect of running your daycare, feel free to seek professional advice on how to manage your finances successfully.

- Easily compile monthly and year-end tax statements, total revenue and income reports, balance sheets, customer statements and more, giving you a full picture of the health of your child care business.

- Procare understands the importance of your role in managing a center, daycare or school.

- This provides a flexible semi-professional environment without a long-term lease.

- Then establish a budget, enter beginning balances, select a fiscal year and reconcile your checkbook.

- Contact the state childcare licensing agency in your state to understand what insurance you will need.

Register Your Business For Taxes

Know that the goal is to use these funds as an investment that https://www.facebook.com/BooksTimeInc/ will yield profitable returns in your business. While digital marketing provides the best return on investment, local impressions with flyers, signs, and sponsorships help, too. Mix online and real-world tactics to cover all the angles in promoting your own business throughout the community. Building an informational website using DIY sites like Wix lets you update content instantly. Or hire a freelancer from Fiverr for a fully custom responsive site integrating enrollment forms and payment processing. Your website showcases programs, photos, and testimonials for prospective families.

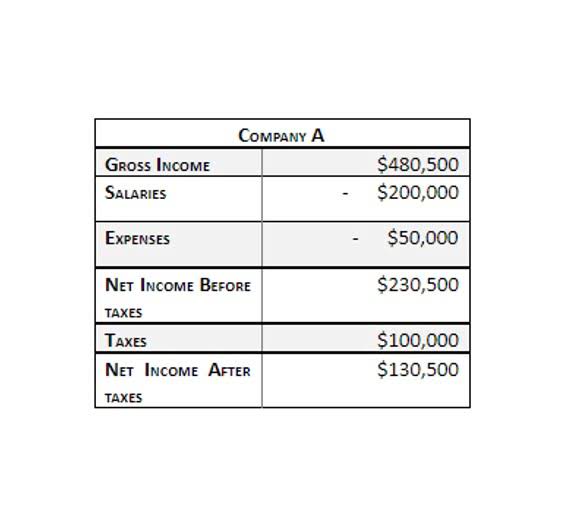

Effective budgeting is a critical component of financial management for daycare accounting for daycare business facilities. By creating and adhering to well-structured budgets, daycare owners can proactively manage their expenses, allocate resources efficiently, and anticipate potential cash flow challenges or opportunities. Compliance with Labor Laws and Regulations- The daycare industry is subject to a myriad of labor laws and regulations, including minimum wage requirements, overtime rules, and employee benefits. Failure to comply with these regulations can result in costly fines and legal penalties. By staying informed and implementing robust processes for tracking and adhering to these regulations, daycare owners can mitigate risks and maintain a compliant and ethical workplace.

- With your bookkeeping records in order, you can figure out your profits and use that to estimate your taxes.

- Efficient financial management includes finding ways to reduce costs without compromising quality.

- 😉 We have to concern ourselves with expenses in order to run a profitable business, as you know.

- A recent Census Bureau report found that the number of children living only with their mothers has doubled in the last 50 years.

- The ability to generate detailed reports on revenue, expenses, attendance and any other pertinent financial data is key to making informed decisions.

Mastering accounting essentials is crucial for the long-term success of any daycare business. An organized bookkeeping system is the only way to keep track of your daycare business transactions. By recording your expenses and revenue, you can stay within your budget, find discrepancies, and save on tax deductions. Bookkeeping can be a tedious process, especially if you’re manually managing your finances. Transitioning to digital software, https://www.bookstime.com/ like brightwheel’s billing and payments product, will make it convenient for you to manage payments, deposit funds, centralize record keeping, and more.