Content

As you can see, if you really want to tame that ecommerce accounting beast, you need both great tools and, at some point, a great ecommerce accounting specialist. We’re sorry to say that this one can be overwhelming and frightening, like the sales tax monster in the picture. With each state adopting its own laws around sales tax, it can feel like you’re being set up to fail. It’s important to keep your books to track your business and financial health easier. Even though bookkeeping may seem tedious and time-consuming, it is vital to the success of an eCommerce business. An accurate and up-to-date financial report would facilitate making sound business decisions.

Financial Solutions can help you navigate the complexity of tax in an online sales environment. Without cash available to pay suppliers, staff, taxes and other bills, your business and reputation will suffer. Just because you have cash in the bank doesn’t mean that your store is profitable. We’ll get to know your business, goals, budget, and accounting needs. Then, you are paired with a highly experienced eCommerce bookkeeper aligned to your specific business needs. At xendoo, we integrate with the most popular inventory tracking apps to help support your business.

Better Data for Better Decisions Starts Here

Think of it as a subset of business accounting that is specifically set up to handle the unique needs of an ecommerce provider. By connecting your bookkeeping software to a solution like Link My Books, you will simplify the entire process. (It will even make filing your tax return easier and more accurate!) Link My Books was designed with https://www.bookstime.com/articles/ecommerce-bookkeeping ecommerce businesses in mind. The most important consideration when thinking about bringing on an ecommerce accountant is the cost. As your business grows and becomes your full-time job, your obligations increase, and so does your need for accurate books. This is a critical time to invest in accounting services with Seller Accountant.

Bookkeeping for an eCommerce business is the process of tracking and recording all of the financial transactions made by the business. Cost of Goods Sold, or COGS, can be one of the most difficult concepts for online sellers to wrap their heads around. Even if a seller understands the basic concept, it can be difficult to plug COGS into accounting software or report COGS in a way that gives you a clear look into your business’s financials. Seller Accountant has helped over 200 ecommerce businesses maintain accurate accounting records.

Accurate Ecommerce Accounting

See what running a business is like with Bench on your side. Try us for free—we’ll do one prior month of your bookkeeping and prepare a set of financial statements for you to keep. Ready to save time and money while having the financials you need to make informed business decisions? We have a simple and straightforward process for new clients. Our team of experts works closely with each client to assess their business, understand their goals, and provide accounting services as a seamless extension of your existing team. Make the payment process as easy as possible for your customers.

- Conversely, showing a profit on your P&L at the end of the month doesn’t guarantee that you have cash available either.

- Whether your store is a small business or a big one, there will be challenges.

- It makes a difference to know how to treat the information you are getting from Shopify in your accounting system.

- To learn more about ecommerce financing options and understand the real costs for your business, check out our free ecommerce loan calculator.

- Looking at the top of your income statement and scrolling to the bottom— you first subtract from revenue your cost of goods sold.

- We’re experts in ecommerce bookkeeping, so you don’t have to be.

- Therefore, your books need to reflect the difference between gross sales, sales tax, merchant fees, and the final deposit on your bank statement.

With gross margin analysis we take into consideration all the factors affecting your business. If you have read until here, you should have a pretty clear understanding of why using an ecommerce bookkeeping specialist is important in maintaining accuracy of your books. Financial Solutions is a one stop shop, where we have experts in bookkeeping, taxes, financial planning and investment management. If you think of it in a Shopify (or online store) context, bookkeeping is like uploading all your products, pricing, images and product descriptions. Accounting is looking at your Shopify dashboard and analytics and interpreting the data to understand what happened to those products over a period of time.

Your Team of Ecommerce Accountants

Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. Alternatively, you can set up two accounts, a Shipping Income account, and a COGS Shipping Expense account. Flat fees collected from the customer go in the former, and payments to shipping vendors go in the latter.

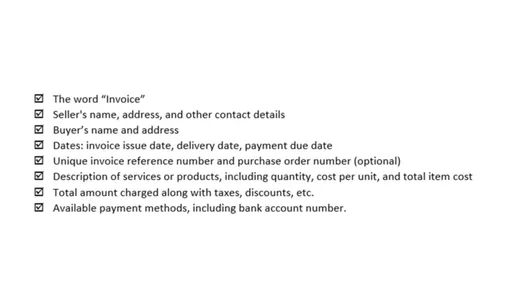

How to do bookkeeping for ecommerce business?

- Determine how you want to track and cost your inventory.

- Download retail accounting software.

- Create templates for sales orders, invoices, and receipts.

- Start tracking your inventory.

- Create a balance sheet, income statement, and cash flow statement for your first month of business.

Decimal ties the website, payment systems, inventory, and delivery together to keep everything connected and updated in real time. For accounting purposes, this debt only matters once the money leaves your account. The two accounting methods are cash accounting and https://www.bookstime.com/ accrual accounting. An ecommerce company can use either method, but not both at once. Thankfully, ecommerce accounting is more than just homework for business owners. It’s also the process of gathering all of the information you need to reach your business goals.

Smart Start for Ecommerce

With growing sales, multiple transactions, refunds and other movements taking place in your account it can become difficult to understand your current cash position. Bookkeeping is the recording of all financial transactions and movements of cash that take place in your business. Ecommerce accounting also includes running financial reports such as profit and loss statements and a statement of cash flows.

We funnel all your financial data into one accounting system. Including additional setup via applications or custom software. You’ve set up your online store on Shopify and are taking advantage of the cloud to sell your products 24/7 around the world. Acuity provides the external guidance to successfully implement the technology and processes to manage and grow your Ecommerce business. To learn more about ecommerce financing options and understand the real costs for your business, check out our free ecommerce loan calculator. At Financial Solutions we offer our Shopify business clients all of the above services and more in a choice of 3 packages to match their size, volume of transactions, and desired growth.

Best Accounting Software Picks for Ecommerce Companies

This startup financial model is used to negotiate the size of the option pool needed at a venture round. This is as user-friendly and adaptable as possible to suit most SaaS businesses. Designed for a startup with multiple departments; use to budget for hiring and non-FTE spend. I was originally referred to Sue Keddington to coach me in QuickBooks and set up our company file. This is what a good financial plan will do, create a roadmap with milestones so you can see your progress along the way. Your Xendoo team is always available by live chat, email, or phone call.

Despite what some people believe, any business that sells taxable products needs to collect sales tax in the jurisdictions where they have nexus. It is where your business has a significant presence (offices, employees, sales reps, and property (including inventory)). It doesn’t matter whether the business is online or brick and mortar. And it doesn’t matter if other people are following the rules or not. You should be aware that this is a liability issue for your business now.

Ready to grow your ecommerce business?

It doesn’t take long before you find yourself tracking cash flow, fixed costs, variable costs, balance sheets, returns, reversals, and sales tax on multiple platforms. Many ecommerce business owners rely fully on accounting software. These services can integrate directly with your ecommerce platform and bank account, effectively automating a huge amount of bookkeeping labor and reducing the potential for human error. By using Link My Books, your accountant can easily link your accounting software to your eCommerce store, to simplify the entire process and derive even better insights. Acuity provides a complete sales tax management service for our ongoing monthly customers. We understand the complexities of sales tax compliance for online sellers as well as how to implement a manageable sales tax compliance process.

The Bench platform gives you monthly financial statements and expense overviews to keep you in control of your money. At-a-glance visual reports help you see the big picture and give you actionable insights to help you grow your business. Your team of small business experts imports bank statements and prepares financial statements every month. Your Bench bookkeeper works in-house, and they’re backed by our in-house research team to provide you with informed answers to complex questions.